ASEAN - A Promising Destination for FDI

In the context of global trade marked by various shades of gray due to political conflicts and numerous other challenges, the Southeast Asian region continues to be a promising destination for foreign investors.

Over the past 30 years, ASEAN countries have witnessed abundant inflows of foreign direct investment (FDI) thanks to significant growth potential, along with many trade agreements being signed and ongoing structural transformation processes. More importantly, it's the incentives that Southeast Asian countries offer to investors. The governments of these countries prioritize attracting investment capital, focusing on important sectors such as energy transition, digital economy, wholesale and retail trade.

In 2022, FDI inflows into the ASEAN region reached a record high of 224 billion US dollars, accounting for 17% of global FDI capital. This achievement is particularly remarkable considering it occurred amid a backdrop of severe global economic downturn, with global FDI witnessing a 12% decrease due to various challenges such as political conflicts, rising food and energy prices.

While Singapore, Malaysia, and Vietnam have demonstrated outstanding achievements in the technology sector, Indonesia and Thailand benefit primarily in the electric vehicle sector. Malaysia currently holds a 45% global market share in the semiconductor industry. Apart from manufacturing, the financial services sector in ASEAN has also shown promising growth, although it remains primarily concentrated in Singapore.

In recent years, Singapore has consistently led the region in terms of the volume of FDI from foreign investors, largely due to the country's highly advanced, comprehensive, fair, and transparent legal system. The nation identifies three key sectors for attracting investment, including new manufacturing, exports, and labor.

The Thailand Board of Investment (BOI) has announced that in 2023, the country attracted an FDI of 18.5 billion US dollars, representing a 72% increase over the same period of 2022. Thailand offers various tax incentives, such as exemptions or reductions on import duties on machinery and equipment, corporate income tax exemptions or reductions, and exemptions from import duties on essential raw materials used in the production of export goods.

Previously, FDI inflows into Indonesia reached 45.6 billion US dollars in 2022, marking the highest level in the history of Southeast Asia's largest economy.

According to IMF forecasts, with a GDP growth rate of 6.1% in 2024, Cambodia is poised to become the fastest-growing economy in Southeast Asia. The country has bolstered its cooperation through free trade agreements with China and South Korea.

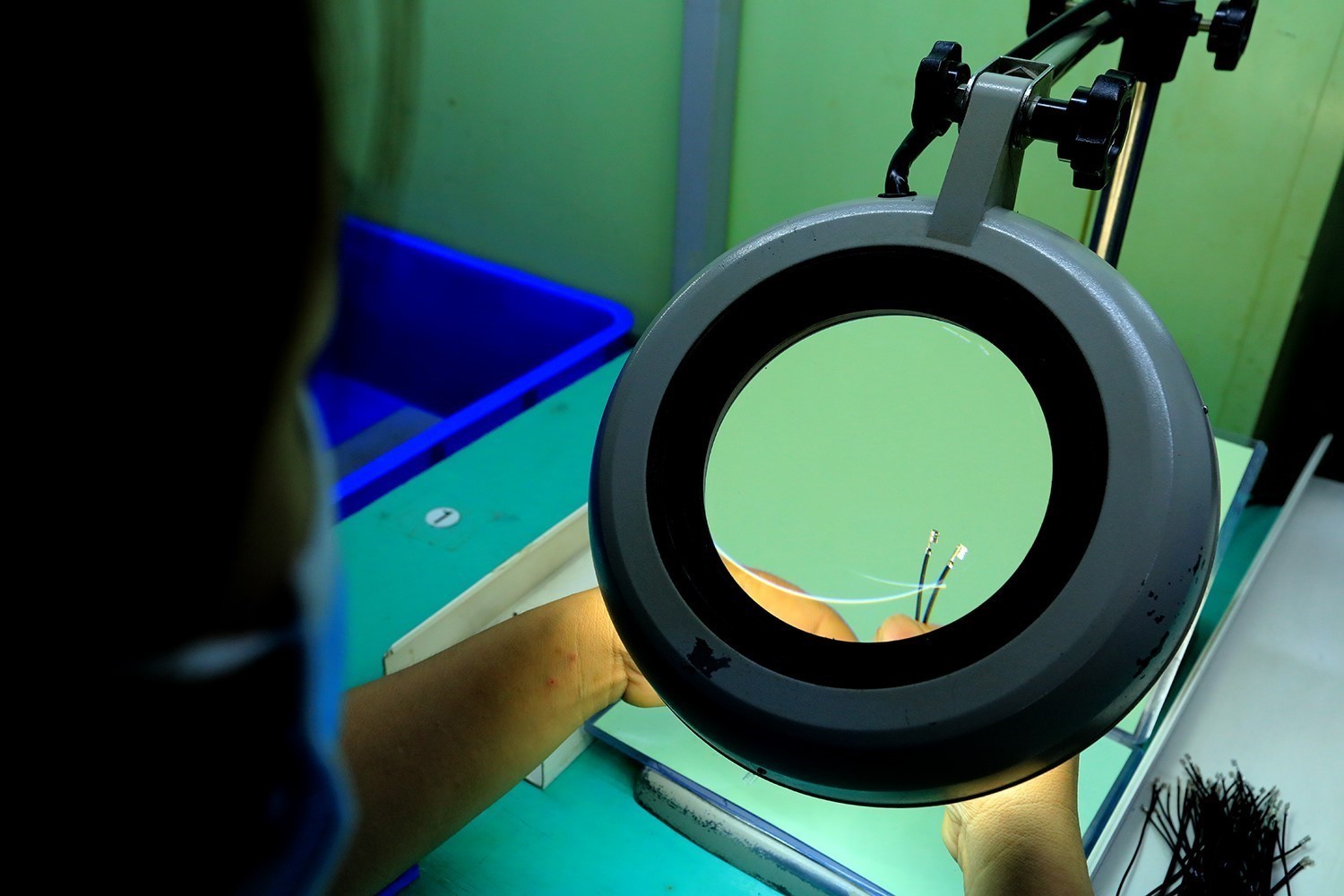

The US leads as the top investor in projects across Southeast Asia, followed by China, the ASEAN bloc, South Korea, and Japan. These investments have primarily targeted manufacturing, a key sector for the region.

Vietnam also shines as a standout performer in the region. "Vietnam continues to be a magnet for attracting FDI due to its low wages, abundant and skilled labor force, young population, geographic proximity to China, and the shift towards high-tech economic value chains," noted Lawrence Yeo, CEO of AsiaBIZ Strategy (Singapore).

Significantly, trends in manufacturing and supply chain relocation closer to home or towards allied blocs (especially following geopolitical conflicts that forced countries to choose sides) will become more pronounced in 2024 and beyond as investors seek security for their investments.

Recognizing the importance of attracting FDI for economic development and improving societal well-being, Southeast Asian countries will continue to implement additional policies to support foreign investors, aiming to build a stable business environment with fair and efficient legal systems that do not discriminate.

Story: VNP Photos: VNA Translated by Nguyen Tuoi

- Designed by Trang Nhung